“The time has come for policy to adjust, the direction of travel is clear.”

Jerome Powell

The annual Jackson Hole conclave of global monetary policy-makers, academics and gurus, Fed Chair Powell made official the Fed’s monetary policy pivot, announcing that it was time to cut interest rates. Even though the announcement was much anticipated, it had an immediate impact on financial markets:

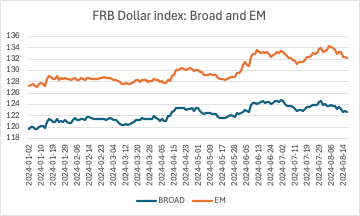

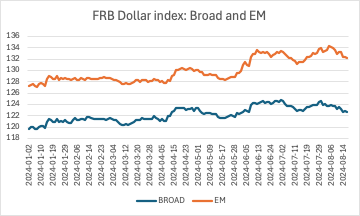

· The dollar index (DXY, a weighted average of the dollar exchange rate against major currencies) fell to its lowest level in 28 months

· The 10-year Treasury yield fell by 5 basis points (bp) to 3.81%, down 86 bp since its high of 4.67% on April 27th

· The MSCI Emerging Markets Index (representing Emerging markets ,EM, stock markets) rose to 571, a 2.7% gain over its February 16 year-to-date low

· Major bell-weather EM currencies (Mexican peso, South African rand and Indonesian rupiah) all gained against the dollar

· Oil prices (WTI) gained 3% today, rising to $74.35/bbl

The key issue now is the timing and the size of the interest rate cuts. Markets anticipate a total of 1% cuts in the benchmark Fed Funds rate in the remainder of 2024. The next FOMC meeting is scheduled for September 17-18-the question now is whether the cut will be the usual 25 bp or a more drastic 50bp.

The easing of US monetary policy will provide welcome relief for emerging markets and developing countries. Lower interest rates and a weaker dollar should ease the burden of external debt servicing. At the same time, lower dollar interest rates could allow the major EM countries to follow suit and ease monetary policy. The Fed move could also help reverse capital flows away from the US towards EMs. Finally, the Fed move is likely to be followed by interest rate cuts by major central banks, providing further relief.