Powell's Gambit

Easing Begins

As expected, Fed Chair Jay Powell delivered a 50 basis point (bp, 0.5%) cut in the benchmark Fed Funds rate at the latest Federal Open Market Committee (FOMC) September 18-19 meeting. The interest rate cut was great than expected—most analysts forecast a more prudent 25 bp cut.

The Fed move signals the beginning of an easing of U.S. monetary policy. By pushing for the larger cut, Powell is underscoring three points. First, the U.S. economy is resilient and on track for a soft landing. Second, while the anti-inflation war has not been won, the trends show that inflation (as measured by core PCE, the Fed’s preferred indicator) is close to the Fed’s 2% target. And finally, while the risks are balanced, the Fed would like to avoid causing a hard landing. These points are reflected in the September 18 FOMC Statement (https://www.federalreserve.gov/monetarypolicy/files/monetary20240918a1.pdf) :

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee's 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.”

To discuss the impact of the Fed decision, we should underscore a few points:

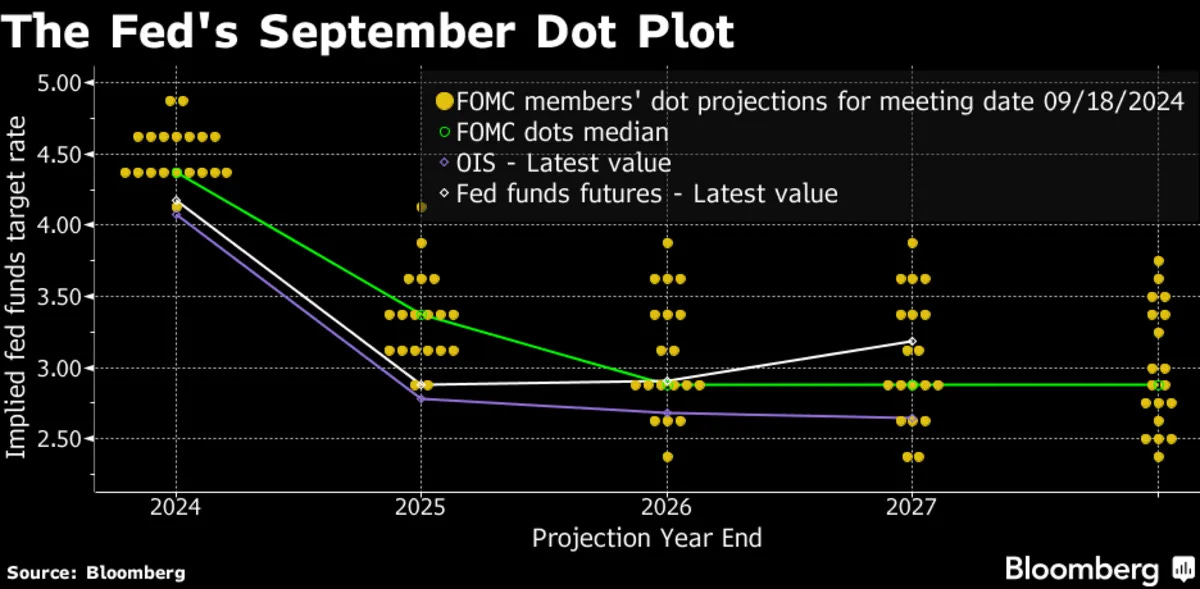

· While the September rate cut is significant, the trend is more important. It is expected that we will see two more 25bp rate cuts by year-end, bringing the total cuts to 1% by December. Policy easing is expected to continue at least into 2025. The Fed Dots Plot (which shows the spread of FOMC member forecasts of future rates) shows an average Fed Funds rate of 3.25% by end 2025.

· Fed policy works with a lag. Assuming that the monetary tightening of the past two years did its work, it took 9 months after the first rate hike in March 2022 for inflation to peak, and 30 months for it to fall under 3%. So, don’t expect an impact until 2Q25

· The Fed has been shrinking its balance sheet in the past two years, from a peak of $9 trillion in April 2022 to about $7 trillion today. This monetary tightening (QT) is expected to continue, which will keep some pressure on the bond and mortgage markets

· Internationally, the Fed move is likely to accelerate monetary policy easing already under way in the main central banks (with the possible exception of Japan)

· Stronger macroeconomic prospects in the short and medium term should boost global growth.

· Emerging markets will benefit from lower global interest rates and the weaker dollar,

We should recognize that significant risks remain. Oil prices volatility, US elections, trade wars, to name a few. To quote Churchill, 'Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.'