The year 2025 starts with many challenges and very few promises. The election of President Trump casts a long shadow and will play a major role on potential outcomes. Growing fiscal imbalances and piling public debt, the global rise of right-wing populism, the threat of trade wars, financial markets turmoil and rising geopolitical risks pose particularly difficult dilemmas for government everywhere. what follows, I highlight a few of the issues that will shape our world in 2025.

Global Debt Blues: The COVID pandemic accelerated the upward path of global public debt, now standing at about $100 trillion, on track to reach 100% of global GDP by 2030. The main culprits are the U.S., China, France, Italy, the UK and Brazil and South Africa. Yet, these countries are in an unsustainable fiscal path, with little room for maneuver and for that matter credible plans to address their ballooning public debt. The IMF estimates that these countries need a fiscal adjustment of 3.5-4.0% over several years (through expenditure cuts and tax increases) to stabilize their public debt situation. Such a drastic austerity program will require political will and capital, in short supply.

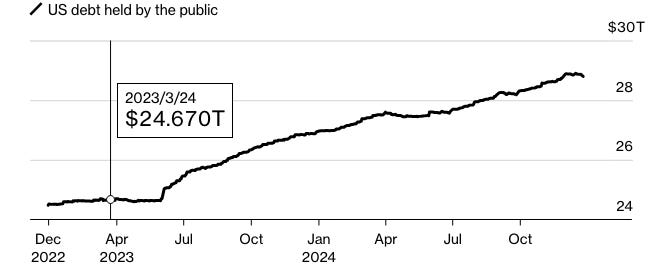

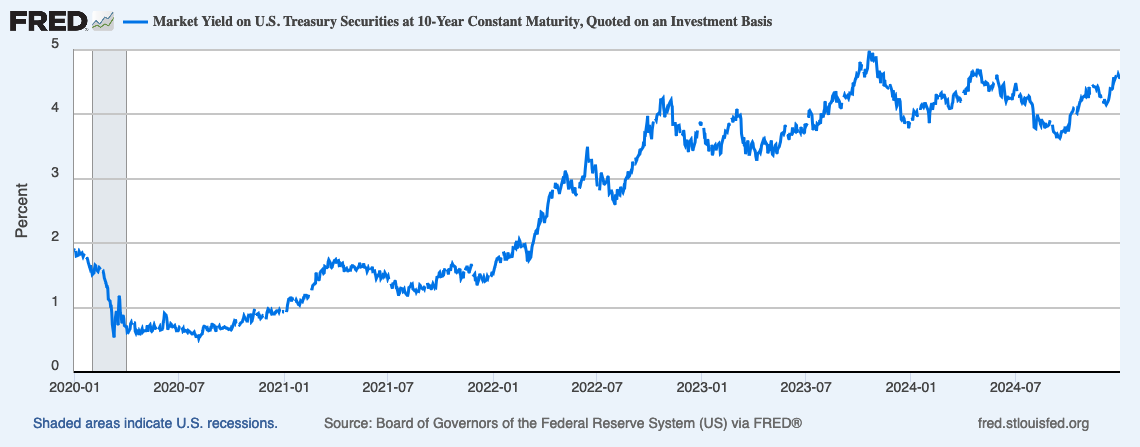

Stressed Bond Markets The Trump program of deep tax cuts, higher spending, trade wars and high tariffs and deregulation will worsen an already difficult fiscal trajectory. The Trump administration will inherit a federal deficit of 7% of GDP and a federal debt held by the public of almost $29 trillion (100% of GDP). President-elect Trump has promised to renew the 2017 tax cuts (due to expire in 2025). In combination of all his other electoral promises on spending and taxation, it is estimated that his policies would add almost $8 trillion to the Federal debt by 2035. The bond markets have reacted to the uncertainty with increased volatility, with the 10-year bond yields rising to 4.53% by the end of 2024, the highest 2024 level since end-May.

The volatility of the bond markets has been magnified by technical problems in the markets, in particular the sharp decline in the number of “primary dealers”, who are essential in the smooth functioning of the markets. Since the 1980s, the number of primary dealers has dropped by half to two dozen today. In combination, the expectation of higher deficits and stubborn inflation increase the risk of loss of confidence in the critical U.S. Treasuries, who represent one of the anchors in global financial markets.

Rising Geopolitical Risks in the Middle East: The Trump presidency, which will start on January 20, looms large over the region. The regional situation has changed drastically in the past few months, with the overthrow of the Assad regime in Syria, the endless Israel-Hamas war and the literal destruction of Gaza, the crushing of Hezbollah in Lebanon by Israel and the Israeli air raids against Iran. In 2025, the world could face one of three scenarios. First, , the standoff between Iran on one side, and the U.S. and Israel on the other continues. Trump repeats his first term’s policy of maximum pressure on Iran, with no resolution of the status quo. Second, Iran and the U.S engage in a dialogue to reduce tensions, resulting in an easing of the sanctions regime. Third, an all-out and lengthy military confrontation occurs between Iran on one side and the U.S. and Israel on the other. At this time, it is unclear which outcome is the most likely. However, the prospect of a Trump presidency has emboldened the hawkish elements in both the United States and Israel, who have been calling for a “shoot first, ask questions later” policy of military action for the destruction of Iran’s nuclear infrastructure by the United States or Israel (or a joint action by the two countries). Such an outcome would have unpredictable results and would almost certainly lead to a further escalation of the conflict.

Europe’s Deepening Crisis: Europe faces a pile up of threats and is becoming increasingly ungovernable. The two main pillars of the eurozone, France and Germany are in the midst of a prolonged political crisis. President Macron of France, at the mid-term of his presidential term, faces a hostile parliament and political gridlock. Germany faces a general election with a rising threat from the far-right AfD party. More broadly, Europe’s mainstream parties are losing ground to a challenge from far-right populist parties, which are in power (or share power) in 7 out of the 27 countries of the European Union. Europe will also be under pressure from a Trump administration, which is threatening tariffs while at the same time pushing for increased defense spending commitments. Finally, the war in Ukraine and Russia’s revanchism pose continued threats on the political and energy front.

Trade Wars and Geo-economic Fragmentation: Candidate Trump famously said that the most beautiful word in the English language is “tariffs”. President-elect Trump is making them the centerpiece of his economic policies, threatening new ones against friend and foe alike. Trump has threatened tariffs of 25% against Mexico and Canada if they don’t stop illegal immigration to the U.S., tariffs of up to 100% on China, as well as hefty tariffs on Europe. In his worldview, tariffs are an instrument of both economic and political power. In his latest iteration of trade wars, Trump is also demanding that the BRICS1 countries abandon any efforts to create a new international currency as an alternative to the U.S. dollar, or face 100% tariffs. The weaponization of tariffs and the dollar is likely to have several consequences. First, it will be met by retaliatory action by countries under threat. Second, it will lead to disruptions of supply chains as multinational corporations and countries scramble to adjust trade flows to the jumble of tariffs. Third, with the the chasm between the Global North and the Global South will deepen and geo-fragmentation will accelerate as emerging markets seek to protect themselves against aggressive U.S. moves.

Monetary Easing on Pause: The monetary easing by major central banks that started in mid-2024 is likely to slow down or be paused. Furthermore, we should witness a greater divergence between countries. The period of rapid global disinflation seems to have hit a roadblock, especially in the U.S. In combination with expectations of strong U.S. growth, this should lead the Fed to slow down the pace of monetary easing, with the benchmark Fed Funds rate expected to be cut by 1% by the end of 2025. Central Banks in the UK and Canada are also likely to be cautious in their monetary easing path. The eurozone might have some room for faster interest rate cuts.